The Elimination of School Property Taxes: Bad for Radnor and for PA

November 3, 2017

On November 7th, Pennsylvanians will head to the polls for a municipal election. Although it’s an off-year, this election will include a critical vote on a proposed amendment to our state constitution. The amendment reads:

Shall the Pennsylvania Constitution be amended to permit the General Assembly to enact legislation authorizing local taxing authorities to exclude from taxation up to 100 percent of the assessed value of each homestead property within a local taxing jurisdiction, rather than limit the exclusion to one-half of the median assessed value of all homestead property, which is the existing law?

A “yes“ vote in this referendum will allow local taxing authorities―counties and school districts―to exempt up to 100 percent of the assessed value of each homestead from taxes. Simply put, local taxing authorities can eliminate property taxes on people’s homestead (primary home).

On the surface this would appear to be a positive change for Pennsylvanians. Who would be against a possible tax cut? The proponents of the bill, namely the primary sponsor Rep. David Maloney of Berks County, advocated the constitutional amendment as a means to ease the tax burdens of aging residents managing retirement and the costs of home ownership. Maloney suggests it would be “immoral” to “ take a person’s home after [they] work[ed] their whole life to pay for it.”

Maloney makes a reasonable point here. Property taxes can indeed pose difficulties for ordinary taxpayers. In Philadelphia, delinquency rates have hovered around 5-9% for a number of years now, demonstrating some of the significant strain the tax creates. Addressing the widespread struggles of taxpayers must be at the forefront of dialogue in our communities and in Harrisburg. But all of the facts must be part of the conversation. We must fully examine the less obvious but perhaps more significant ways the amendment could impact Pennsylvania, and more specifically, our school system.

First, the amendment would constitute a major policy shift. Currently, our state relies on property taxes to pay for our primary functions of government. Other states like California and New York rely more heavily on state income taxes to pay for government. Thus, in order to move away from property taxes, we will have to make up for the lost revenue through other taxes or a heightened income tax. Essentially, we will undergo a tax shift.

In terms of schooling, many PA districts rely on property taxes, not state resources, to fund their operations. Take Radnor Township School District for instance. Of the $96,315,286 budget for the 2017-2018 school year, nearly $80 million is collected from local sources, or about 83.06%. The state supplies a mere 15.65%, rounding out to slightly more than $15 million. This overwhelming reliance on local sources puts the burden of financial management in the hands of local school boards, not distant state legislators.

Notably, we do not know for certain if the passing of this amendment will or will not actually lead to changes in the school property tax system. As the amendment does not directly pertain to schooling, future events can only be speculated. However, one state senator, Mario Scavello of the 40th district, did go on record with what he hopes will occur through the passing of the amendment, explaining “I co-sponsored Senate Bill 76, but we weren’t able to get enough support for it in the House… as a result, it’s hit a brick wall. So, we had to go another route to come up with something which, if passed, would allow us to expand Senate Bill 76.” For context, Senate Bill 76 is a formerly proposed bill that would authorize “ the imposition of a personal income tax or an earned income tax by a school district” in order to remedy the losses from former property tax revenues. The bill would also permit districts to continue levying property taxes to pay existing debts, which could mean years of extra tax burdens for residents. Scavello, in detailing his strategy to bolster the related bill, indicates just how the proposed constitutional amendment may serve to transform district funding and enable a tax shift. Still, there remains uncertainty.

If we do take Senator Scavello’s words at face value, the passing of this amendment would be the first step in a long process headed towards abandoning school property taxes, raising the personal income tax, increasing sales taxes or introducing new taxes. The allocated Homestead exemption is currently 50%, and if it were to grow to 100% under this amendment, the role of property taxes in schooling may completely change. There will be no winners, but rather one big loser: local control of public education.

Our district serves as a perfect example of the potential of local management of schools. As high school juniors in Radnor, we come from a position of great fortune, and we have an intimate sense of how essential our district is in overseeing the affairs of our schools. Because our administrators and school board know Radnor for what it is, they can effectively take on the mighty responsibility that is keeping our schools alive and thriving. Students, from kindergarten through 12th grade, actively enjoy the innumerable benefits that local control of schooling facilitates. Whether it be investments in new classroom technologies or renovations of our facilities, the district ensures Radnor maintains its core in devotion to excellence. But surely, much of our success comes from our ability to fund our schools locally. We exist in the system stably, knowing we have the means to fund our operations as we see fit. Radnor residents generally can afford the local contributions that such a large district budget requires.

What about the other side? What about the districts that do not have access to the financial resources affluent districts have? Undoubtedly, the state must play a role in aiding these districts. We do not argue for no state intervention, but rather for targeted, necessary cases. The alternative we seem to be moving towards, centered on overarching legislation for all districts on the educational spectrum, will not be effective. Bringing the hundreds of school districts of PA under one umbrella of state control will take away from the individualized attention failing districts need. It comes down to local control. We know districts and school boards deeply involved in their communities can manage their schools better than the state can. The state elevating itself into a role of dominance, which the elimination of school property taxes may permit moving forward, has proven and will continue to prove not a viable solution.

This is not by any means to say the state should not be involved in school funding. In fact, the state contributing more to districts in need could save Pennsylvania from its school funding crisis. The money must come from somewhere, but it would seem reasonable that Pennsylvanians would be more willing to lend more support to an increase in resources for students than an indirect amendment to the state constitution that could see unknown consequences later. Today, Pennsylvania provides just 34% of public school funding to districts on average, compared to the national average of 45%. This statistic will not change by shifting the tax burden. Our legislators in Harrisburg should reevaluate how the state interacts with its districts rather than amend the constitution to perhaps see unknown changes later.

Ultimately, we know inequity between Chester and Radnor will not change by giving Harrisburg the keys. Instead, the students of our state will be held hostage to the politics of the state legislature. Funding for our schools, which is funding for the future of our state, will be used as a bargaining chip in budget negotiations.

The tragic projections of what might happen if this amendment passes isn’t hyperbole, but rather rooted in historical evidence. In 1997, a less drastic amendment passed that allowed local authorities to exempt property taxes by 50%. To make up for lost funds, income taxes were raised by 1.5%. If this bill passes, will the people of Pennsylvania bear another 1.5% or greater increase? Will Pennsylvania citizens have to endure another ineffective tax shift?

Our own district could suffer the direct consequences of this chaos in Harrisburg. In relation to the aforementioned Senate Bill 76, the RTSD Director of Communications, Michael Petitti, told the Radnorite, “[our budget is] used to educate the children and young adults of Radnor Township. There is ample evidence to suggest that should this amendment pass, the Pennsylvania Legislature would begin to pursue legislation such as Senate Bill 76 that would harm our schools and community at large.” Again, the majority of Radnor’s budget comes from local sources. So, attempting to alter an entire system (which this amendment could start the process of ) without knowledge of the consequences could be dangerous. The passing of this amendment may lead to other votes down the line that strip our district of its control of local funding. It may lead our district and other districts to increased dependency on the state, rather than increased contribution from the state. It will not benefit those districts that struggle under the current funding system, but rather complicate the issue as it stands.

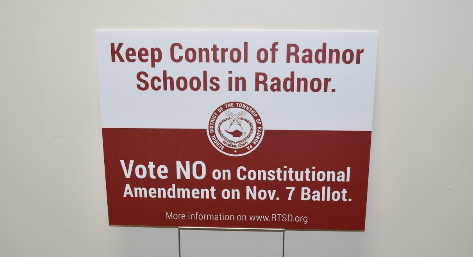

Radnor residents should do their part to avoid these potentially existential ramifications. We wholeheartedly urge our Radnor community to vote “no” on the constitutional amendment on the November 7th ballot.