Inflation and the Nation’s Debt: Prices Surge as the Holidays Approach

https://www.usatoday.com/story/money/personalfinance/2019/02/28/average-grocery-store-bill-cost-is-driven-up-most-by-these-items/39094659/

December 17, 2021

All over the country, prices are on the rise. From gas to groceries, Americans have noticed an uptick in consumer costs and raised their concerns. Many people struggle to understand the causes of these current economic circumstances.

When many Americans started to get vaccinated, life looked like it would return to normal; then, the Delta variant came along. Before the Delta variant, economists and the government hoped people would begin dining out and hosting weddings and other in-person events at a pre-pandemic rate. As the Delta variant emerged, however, many people continued to stay home and purchase goods online. Subsequently, while some argue that the cause of inflation is due to too much money floating around, others say that the nationwide price-surge comes from Americans spending money largely, and unexpectedly, on a narrow set of items and purchases. After the economy plundered during the lockdown, it suddenly took a turn, which some economists say is an inevitable result of coming out of the pandemic.

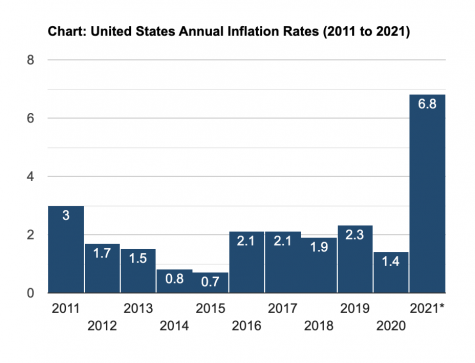

In October 2021, prices rose a tremendous 6.2% from the year before. Economists across the political spectrum argue that the aid package that President Joe Biden signed in the spring fueled more consumer demand than the economy could sustain. Thus, prices have skyrocketed. However, this explanation has been critiqued, and many are arguing instead that the economy needs to provide more employment benefits to its workers in addition to the stimulus aid already provided to workers nation-wide. According to Mr. Miller, an economics teacher at Radnor High School, “One should not have to look very hard for someone or an event to blame for this historically high inflation. The pandemic is the reason and it is the simple economics of supply and demand.” Due to the economy reopening post-pandemic, goods are being purchased at levels the supply chain simply cannot support, causing an imbalance in supply and demand, which leads to inflation. Mr. Miller noted, “Due to supply chain issues and a shortage of workers, the supply of goods has also decreased. So in conclusion, a decrease in supply or an increase in demand would cause inflation. In this situation, we have an increase in demand and a decrease in supply. This explains why inflation is at a historical high.” Likewise, Americans have expressed their concern for the long run as prices become less affordable, but experts are hopeful the current trend will fade by next year.

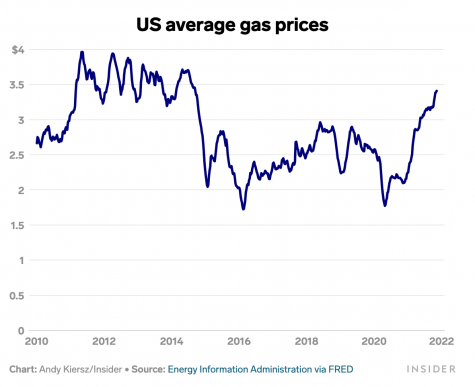

Notably, gas prices have risen suddenly and profoundly. On Tuesday, November 23rd, 2021, President Biden announced an effort to drive gas prices down by releasing 50 million barrels of oil from the nation’s strategic reserve. Despite current efforts, inflation isn’t slowing down. For many, this poses financial concerns as the holiday season approaches. So, when will the dismay of rising prices end?

According to TIME, “Consumer price inflation will likely endure as long as companies struggle to keep up with consumers’ prodigious demand for goods and services.” Economists are hoping inflation trends will turn around eventually, but that could be at least another year. While inflation is concerning, economists are expecting a final quarter of growth, despite the surge in prices.

The issue of inflation lies with the Federal Reserve, and many are pointing out that the issue of inflation isn’t “transitionary,” like many experts are claiming. The Federal Reserve announced recently that it will buy fewer bonds over time, which should help stabilize the economy. However, it will likely take a while before the Fed is able to hike interest rates. On the other hand, raising interest rates sooner than expected could threaten markets and their investors. Hiking rates may not be enough to reverse the current issue of inflation as the problem sources from the supply chain and fiscal spending, which the Fed doesn’t maintain control over.

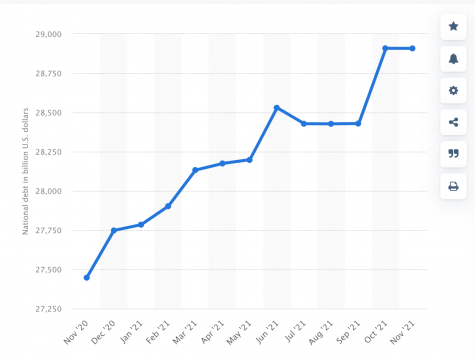

In comparison to the share of GDP, the largest hike happened in 2020 when the pandemic hit. Currently, the United States debt stands at around 28.9 trillion dollars as of October 2021. In addition to the issue of inflation, many are debating whether it is economically feasible to add on to the nation’s mountain of debt. Congress, in charge of the debt ceiling, gets to decide how much the US is allowed to borrow. To understand both sides of the issue, it is fundamental to know how the United States debt works.

Congress hopes to raise the debt limit, but there are restrictions on how much they can raise it due to interest rates and inflation. When the government needs to borrow more money to pay for its economic agenda, it must first pass laws through Congress that determine spending and taxes. If government spending exceeds taxes, the Treasury must finance the deficit by borrowing. Thus, the Treasury issues bonds and bills. Investors give the Treasury money, in return, the investors expect to have that money returned through interest. When bonds are sold to investors, the government gets money to pay its bills, and agrees to pay investors interest. The federal government uses debt to meet all obligations they need to meet. If interest rates are extremely low, the government could borrow an infinite amount. On the other hand, if interest rates are high, the government’s ability to borrow money becomes extremely restricted, since the interest bills would become paramount. Unfortunately, this can place the government and the economy in a potentially dangerous cycle. When Congress borrows money, and then spends it back into the economy, the spending can exceed the economy’s ability to sustain and produce goods and services. In other words, when there is too much spending, and not enough goods to support the spending, inflation develops.

In conclusion, while the inflation facing the United States currently poses a temporary issue, the government must remain vigilant in their efforts to reduce the surge in prices that consumers of American goods and services face across the country. While there are benefits to raising the nation’s debt limit, there are also consequences that may worsen the issue of inflation the nation is already currently experiencing. If not carefully watched, inflation can become a prominent long-term issue that would pose greater problems and threats to the economy.